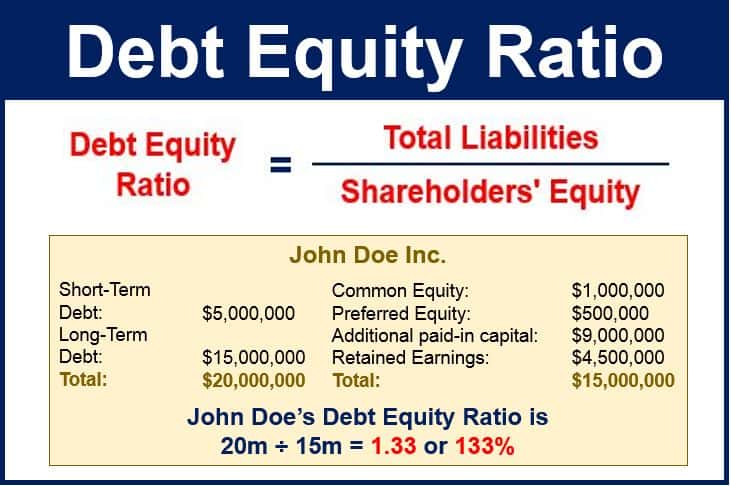

total debt divided by total equity

The cash flow-to-debt ratio is the ratio of a companys cash flow from operations to its total debt. See what makes us different.

|

| Debt To Equity Ratio Formula Calculator Examples With Excel Template |

The assetequity ratio indicates the relationship of the total assets of the firm to the part owned by shareholders aka owners equity.

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

. One divided by the total asset turnover. One plus the total asset turnover 3. One plus the debt equity ratio 2. Debt to Equity Ratio Total Liabilities Total Equity.

Total equity divided by total assets 5. Equity divided by total assets equity plus total debt assets minus total equity from FINC 5310 at Lamar University. AARP Money Map Provides a Trustworthy Actionable Plan Based On Your Current Funds Debts. The debt-to-equity ratio involves dividing a companys total liabilities by its shareholder equity using the formula.

Current liabilities divided by total stockholders equity. Debt Equity Total Shareholders Equity Total Liabilities total shareholder By dividing our liabilities in equity we will get the total debt equity. The total-debt-to-total-assets ratio is calculated by dividing a companys total amount of debt by the companys total amount of assets. What is total asset and total equity.

Stood at 241 as on September 29 2018. Therefore the debt to equity ratio of Apple Inc. RSS Feeds Email Alerts Tear Sheet Contact IR Print. When calculating the debt-to-equity ratio which is total liabilities divided by total shareholders equity it is critical to know which categories should be included.

Current assets - current liabilties. Debt to Equity Ratio 258678 million 107147 million. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Net working capital to total assets.

The ratio gives the investor the approximate amount of time that would be needed to pay off all debt ignoring the. Total AssetEquity ratio In Depth Description. The debt to equity ratio is computed as. This means that for every 1 invested into the company by investors lenders provide 05.

Debt to Equity Ratio 241. Cool Drinks is divided by the following formula by the total equity in all companies around the world. This ratio is a type of coverage ratio and can be used to. The DE ratio is an important metric used in corporate finance.

Debt-to-capital 80 million. 200000 300000 500000 05. The equity multiplier is equal to. DebtEBITDA is a measure of a companys ability to pay off its incurred debt.

This ratio is an indicator of the companys leverage debt used to finance the firm. Total liabilities Total shareholders equity Debt-to-equity ratio 1. Long-term liabilities divided by total stockholders equity. Debt-to-equity ratio is used to evaluate the financial leverage of any company.

The debt-to-equity ratio can also be used to estimate a companys leverage level Fernando 2022. We dont make judgments or prescribe specific policies. Equity ratio uses a companys total assets current and non-current and total equity to help indicate how. The debt-equity ratio of a firm measures a companys capital structure.

Since debt to equity ratio is calculated by dividing total liabilities by shareholder equity the DE ratio for company A will be. Total debt divided by total equity 4. The importance and value of the companys assetequity ratio is dependent upon the industry the companys assets and. Using these numbers the calculation for the companys debt-to-capital ratio is.

Is used to determine the availability of a companys liquid assets by subtracting its current liabilities. Net working capital Total assets. Build A Better Financial Future By Doing So. Cash Flow-to-Debt Ratio.

Use the balance sheet You need both the companys total liabilities and its shareholder equity. Calculating debt-equity ratio is accomplished by taking the total corporate debt and dividing it by the firms total equity. Total debt to equity is total debt divided by total shareholders equity It has from ACCT 150 at Allan Hancock College. Total liabilities divided by total stockholders equity.

The debt-to-equity DE ratio is used to evaluate a companys financial leverage and is calculated by dividing a companys total liabilities by its shareholder equity. Total Debt to Equity MRQ This ratio is Total Debt for the most recent interim period divided by Total Shareholder Equity for the same period. Ad Take Control of Simplifying Your Debt. Total equity is 20 million 3 million 20 x 10 million shares 223 million.

Increasing leverage ratios are a warning sign for shareholders and investors that the company is taking on more debt than it. Total assets - Total EquityTotal Assets. If a company has a total-debt-to-total-assets ratio of 04.

|

| Debt To Equity Ratio How To Calculate Leverage Formula Examples |

|

| Debt To Equity Ratio D E Formula And Calculator Excel Template |

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png) |

| Debt To Equity D E Ratio |

/apple_10k_debt_to_equity_2017-5bfd8744c9e77c0051d9d98a) |

| How Do You Calculate The Debt To Equity Ratio |

|

| Debt Equity Ratio Definition And Meaning Market Business News |

Posting Komentar untuk "total debt divided by total equity"